28

2022

-

02

Oversupply China's high-purity hydrogen price will drop 3.6% year-on-year in 2021

The supply and demand of high-purity hydrogen in China will continue to increase in 2021, and the price will decrease compared with 2020 because the demand growth is slower than the supply growth. The annual average price is 3.19 yuan/cubic meter, down 3.6% year on year.

Supported by the continuous development of downstream chemical, electronic and hydrogen energy markets, China's high-purity hydrogen supply and demand will maintain a growth trend in 2021. In addition, driven by the dual-carbon background, the layout of relevant enterprises in the hydrogen energy industry chain has accelerated. The upstream hydrogen supply has benefited from the rich domestic by-product gas resources, and the capacity growth is particularly rapid. However, the downstream hydrogen energy application is in the early stage of development as a whole, and the demand growth is less than the acceleration of supply growth, leading to the obvious oversupply situation in many markets, and the pressure on hydrogen prices has dropped.

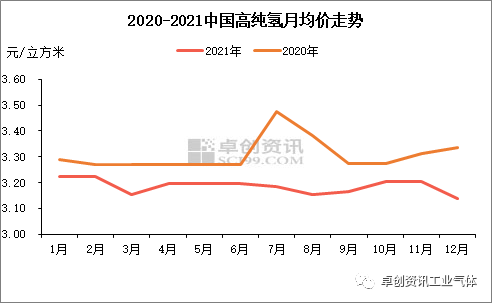

Figure 1

According to data monitoring of Zhuochuang Information, the annual average price of high-purity hydrogen in China in 2021 was 3.19 yuan/m3, down 3.6% year on year. From the trend of the whole year, the average price of each month is also lower than the level of the same period last year, and the overall situation is in a sideways trend. Considering that the transportation radius of hydrogen is limited at present, most of the resources are consumed in local and nearby regions, and the supply of most regions is greater than the demand, the price fluctuation is mainly related to the supply change of some main markets. Among them, the price decline in February and March was caused by the price decline in Henan, Hebei and other places, the price rise in Guangdong supported the national average price in April, and the price decline in Liaoning, Shandong and other places in June and August. The price recovery in September and October was mainly due to the reduction of the upstream feed gas supply and the decrease of hydrogen supply caused by the negative reduction of domestic chemical enterprises in many places. From November to December, with the reduction of load and the improvement of maintenance enterprises, the price fell rationally.

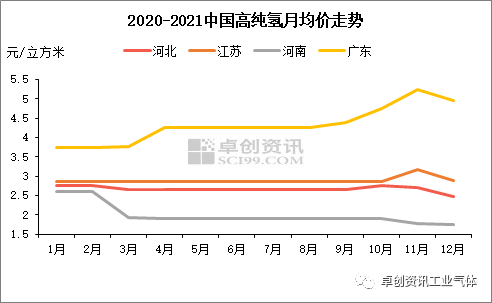

Figure 2

From the perspective of the main regional prices in some major regions, the relative fluctuation range of Jiangsu and Hebei is limited. In September and November, due to the negative reduction of the main production enterprises and the rise of the upstream raw material prices, the hydrogen prices have risen successively. However, with the resumption of construction and the fall of the raw material prices, the prices have been adjusted at the end of the year. The annual average prices in Jiangsu and Hebei are 2.88 yuan/m3 and 2.67 yuan/m3 respectively. The decline in Henan is particularly obvious, mainly due to the concentration of local coking enterprises and the concentration of purification of by-product gas, resulting in obvious oversupply. The market negotiation price continued to fall, and its mainstream ex-factory price fell to 1.5-2 yuan/m3 by the end of the year. The price trend in Guangdong market is different from that in the above market, and the price in Guangdong market is fluctuating and rising during the year. The main reason is that the electronics industry in Guangdong is relatively developed, and the hydrogen energy industry is also a relatively mature area with an early start in China. Its hydrogen market is in short supply. The superimposed periodic maintenance of major enterprises has formed a good support for the market price, and the mainstream ex-factory high price reached 5.25 yuan/cubic meter in the year.

Looking forward to the future, China's high-purity hydrogen supply will continue to increase, and its growth rate is expected to further increase under the support of projects such as wind power hydrogen production and liquid hydrogen. In terms of demand, because hydrogen energy is still in the initial exploration and development stage, short-term demand growth may still be less than supply, and under the influence of oversupply, hydrogen prices in some regions may still fall steadily.

Related news